Scaling through integration? Proposals on integrating greenhouse gas removals in the UK Emissions Trading Scheme

15 min read

The day after former UK Prime Minister Rishi Sunak requested permission from the King to dissolve parliament and called a UK general election, the UK Emissions Trading System (“UK ETS”) Authority launched a consultation on proposals to integrate greenhouse gas removals (“GGRs”) (also known as carbon dioxide removals or CDRs in some markets) into the UK ETS, with a deadline of 15 August 2024 (the “Consultation”). The fact that the announcement was nevertheless released, despite the impending election and expected change of government, indicates broad cross-party political consensus on the development of UK GGR policy and the need to scale GGRs to achieve net zero targets.

While GGRs are presently unavailable at scale in the UK beyond nature-based approaches (such as afforestation, soil carbon sequestration and habitat restoration), the UK ETS Authority anticipates that integrating GGRs in the UK ETS will incentivise investment in, and the deployment of, a diverse portfolio of novel GGR methods. In this article, our team examines: the proposed scope and design for integrating GGRs in the UK ETS; the proposed timing and pathway for GGR integration; and how these proposals align with complementary decarbonisation policies in the UK and EU.

1. Introduction

In practice, the proposed GGR integration will allow GGR operators to generate and sell GGR allowances to UK ETS participants, which may surrender those GGR allowances to comply with UK ETS obligations, as an alternative to purchasing and surrendering UK allowances (“UKAs”). If taken forward, GGR integration would create a new market for GGR activities, by linking with the existing UK ETS market. This integration intends to address what the Consultation describes as a “market failure in the provision of GGRs” caused by systemic under-pricing of GGRs’ social, economic, and environmental value.

The existing UK Net Zero Strategy (set out under the Conservatives) includes deploying at least 5 MtCO2 per year of engineered GGRs, which include Bioenergy Carbon Capture and Storage (“BECCS”) and Direct Air Carbon Capture and Storage (“DACCS”) technologies, by 2030. The UK Net Zero Strategy further foreshadowed a potential scaling of engineered GGRs to 23 MtCO2 per year by 2035, and 75-81 MtCO2 by 2050.[1] Yet, the UK Climate Change Committee’s Seventh Assessment Report indicates that progress on engineered GGRs, in particular, remains “behind schedule”, and that the government’s 2030 removal target is becoming “increasingly challenging”.[2] On the other hand, pricing emissions through the UK ETS (and the EU ETS before Brexit) is already considered a successful pillar of the UK’s climate change policy, having been an important measure in reducing UK emissions by approximately 50% since 1990.[3]

The Consultation reflects political positions agreed between the former UK government and devolved administrations. Publication by the UK ETS Authority (comprising the UK government, Scottish government, Welsh government, and Department of Agriculture, Environment and Rural Affairs for Northern Ireland) after the announcement of a UK general election, but before the prorogation of the UK Parliament, signals that the Consultation represents stable and uncontentious policy proposals by the UK ETS Authority. The Consultation envisions that GGR integration will operate alongside a separate GGR business model, which offers supply-side incentives for GGR projects,[4] published in December 2023.

Although it is improbable that the new Labour government will retract from the Consultation proposal, it may seek to expedite the expansion and scale of UK GGR projects. Regardless, we expect that the government may aim to align its GGR policies with the UK Climate Change Committee’s Sixth Carbon Budget, which identified “the lack of a long-term price signal” as a major policy gap for incentivising GGRs.[5] Integrating GGRs in the UK ETS could also facilitate a faster transition for GGR activities away from subsidy-based support schemes.

2. Adjusting UK ETS Caps

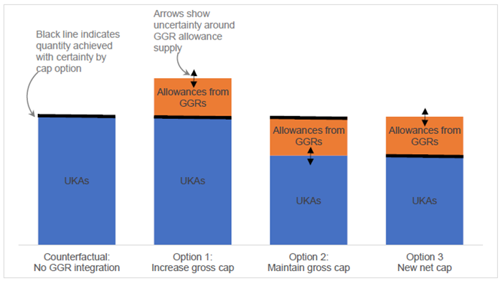

Integrating GGRs in the UK ETS will require adjustments to the UK ETS’s caps. UK ETS caps currently prescribe the number of UKAs over a specified period (for example, the current UK ETS Phase 1 runs from 2021 to 2025, and Phase 2 from 2026 to 2030). Fundamentally, GGR integration will create an additional source of allowances (those from GGRs) alongside UKAs, which the government currently allocates through fortnightly auctions. Accordingly, the integrity of the UK’s net zero targets will rely on the UK ETS caps accurately reflecting GGR volumes that are used for UK ETS compliance purposes. Recognising this, the Consultation considers three options for recalculating UK ETS caps to account for GGR integration.

Option 1: Increase UK ETS caps, by enabliing GGRs to increase the overall supply of allowances in the UK ETS

The first option, considered by the UK ETS Authority, is to issue GGR operators with allowances, in addition to the existing supply of UKAs allocated under UK ETS caps. This option would effectively increase the caps, by an amount corresponding to the volume of GGR allowances entering the UK ETS, and impose no restrictions on GGR supply entering the UK ETS market.

The UK ETS Authority recognises in the Consultation that this option could effectively permit UK ETS participants to emit more from their covered installations than the total limits set by existing caps. Such an outcome could undermine incentives for UK ETS participants to reduce their installation emissions (otherwise known as the risk of “mitigation deterrence”). Furthermore, the UK ETS Authority considers that this option would create a comparatively weak price signal, because the unconstrained supply of GGRs would lower prices and undermine GGR operators’ returns, particularly as technologies mature and deployment rates increase.

Option 2 (Preferred Approach): Apply existing UK ETS caps to GGRs for the initial phase of GGR integration

The second option is the UK ETS Authority’s preferred approach. It proposes replacing UKA allowances with any GGR allowances that are issued to GGR operators. In other words, for every allowance awarded for a GGR activity, the Authority would remove a UKA from the auction share under existing caps. Exchanging emissions allowances with GGR allowances will ensure an identical overall supply of allowances in the market. This exchange of UKAs with GGR allowances will provide certainty and retain alignment with the UK ETS’s net zero consistent trajectory.

Nevertheless, the UK ETS Authority recognises that replacing emissions allowances with allowances awarded for GGR activities may provide insufficient incentives in the long-term (the government’s projections indicate this may occur from the late-2030s onwards), especially where the quantity of GGRs entering the UK ETS exceeds the cap in any given year. In such circumstances, the quantity of emissions allowances will be inadequate to allow for full replacement by GGR allowances, causing an oversupply of allowances in the UK ETS and consequent price reduction, which would depress the GGR market. This raises potential uncertainties for GGR projects relying on ETS integration to achieve financial viability.

Consequently, to address this longer-term concern, the UK ETS Authority is considering measures such as setting revised caps based on the expected volume of GGR supply (akin to Consultation Option 3, below). It may also expand the scope and coverage of the UK ETS, thereby increasing GGR demand. A specific proposal under consideration involves setting long-term UK ETS caps at net zero with GGR allowances, which provides the only source of supply to balance residual emissions from ETS-covered sectors. Alternatively, some analysts suggest that the UK ETS Authority could set UK ETS caps at a “net negative” level.[6] This would mean that the UK economy would remove more emissions than UK ETS participants emit. The additional demand required to achieve such net negative caps could derive from additional regulatory obligations, either from within or outside the scope of the UK ETS.

Option 3: Set new, lower caps to which GGR volumes do not apply

The UK ETS Authority’s third option would involve reducing UK ETS caps (and, thus, the number of auctioned UKAs) by the expected supply of GGR allowances entering the UK ETS. Allowances issued to GGR operators would then enter the market in addition to the supply of allowances set out by the revised caps. These revised caps would not limit the number of allowances distributed to GGR operators.

However, uncertainties in the initial scale of GGR deployment would make it challenging for the UK ETS Authority to forecast GGR supply, for the purposes of setting lower caps, accurately. If actual GGR deployment is lower than expected, the constrained allowance supply will result in high allowance prices. On the other hand, over-delivery of GGRs will increase covered emissions from the UK ETS by the amount of any GGR allowances exceeding the expected supply, with no impact on the UK’s actual economy-wide emissions.

In the long-term, greater certainty over GGR supply means that the government could set revised caps with increasing confidence, thereby reducing the risk to UK ETS participants from the possible under-delivery of GGRs.

Summary of Options

On one hand, Option 1 creates a potential mitigation deterrence risk for UK ETS participants. Its proposal to enable unrestricted integration of GGR allowances in the UK ETS could also suppress allowance prices, and the financial viability of GGR activities, especially as GGR deployment increases over time. On the other hand, implementing Option 3 effectively will necessitate accurately pre-empting annual GGR deployment rates. While achieving this with increasing certainty is likely possible in the longer-term, inaccurate forecasting could produce either excessively high allowance prices, or increase emissions from covered sectors under the UK ETS.

Option 2, the UK ETS Authority's preferred approach, reduces the mitigation deterrence risks inherent in Option 1 by maintaining (rather than increasing) an identical supply of allowances in the UK ETS, following GGR integration. Replacing UKAs with the number of GGRs actually supplied into the UK ETS may also provide additional certainty about the consistency of the UK ETS’s alignment with the UK’s net zero targets. This means that, in the short term, at least, Option 2 is likely to be the optimal model for adjusting UK ETS caps to account for GGR integration. Nonetheless, the UK ETS Authority is simultaneously considering how Option 3 might sustain GGR demand in the longer-term.

3. Allowance Distribution

GGR integration will involve creating a new source of allowances that can be used for compliance purposes under the UK ETS. Currently, the Consultation proposes that GGR operators be issued allowances “ex-post” in the UK ETS, that is, only after a removal has occurred and been verified. This approach represents the most environmentally robust form of allowance distribution, and is identical to established practice in voluntary carbon markets (“VCMs”).

The Consultation clarifies that the UK ETS Authority’s proposed issuance of ex-post allowances will not preclude the opportunity for GGR operators to agree offtake arrangements outside of the UK ETS. Such agreements would provide revenue for GGR operators to support initial costs related to GGR deployment. While the optimal policies for ensuring that GGR operators retain opportunities to harness either VCMs or the UK ETS remain under active consideration, essential factors for facilitating such opportunities may include ensuring alignment of methodologies, carbon accounting, in addition to harmonised measurement, reporting, and verification (“MRV”) systems.

In addition, the UK ETS Authority expects to award allowances directly to the GGR operator or developer. Notwithstanding this, it seeks further evidence on circumstances in which it might be appropriate to award GGR allowances to other actors, particularly those operating within complex supply chains (such as biochar carbon removal or enhanced rock weathering).

4. Allowance Differentiation

The Consultation clarifies that allowances issued to GGR operators can be purchased, traded, and surrendered by UK ETS participants for compliance purposes. However, the UK ETS Authority is exploring whether there are additional benefits to differentiating UKAs from allowances generated by GGRs (for instance, by identifying them as either “GGRAs” or “GGRAs from X” technology). This type of differentiation could give holders of those allowances more information on how they entered the market. With this, differentiation could affect allowance prices, market efficiency, and liquidity, as well as encourage GGR purchases for non-ETS compliance reasons.

5. Permanence

The UK ETS Authority purports only to consider GGRs for inclusion in the UK ETS where there is “sufficient confidence” that the GGRs achieved are “highly durable”, non-permanence risks are “minimal”, and in any event can be “sufficiently managed”. Yet, the Consultation acknowledges that there is no accepted evaluation framework for, or definition of, what constitutes “sufficient permanence”. It proposes to apply the following three-part permanence framework for GGR integration in the UK ETS:

- GGR projects must demonstrate that they can store CO2 for a minimum time (yet to be determined) to be eligible for UK ETS integration.

- If a reversal occurs, the framework will apply a liability measure to the GGR operator (or other entity responsible for the stored CO2). This measure may include requirements to purchase and surrender UKAs, or GGRs from outside of the UK ETS, equivalent to the rereleased emissions.

- A fungibility measure might apply to certain GGR methods. For example, the UK ETS Authority may award GGR methods that store carbon for shorter periods, or with higher reversal risks, with fewer allowances than more permanent and secure GGR methods. This measure may include operators contributing to a “buffer pool”, or creating “equivalence ratios” for different storage methods, although designing and implementing either of these options might cause political challenges.

6. Integration Pathway and Timing

The Consultation suggests the earliest feasible integration date will be 2028 (midway through Phase 2 of the UK ETS). Factors underpinning this date include the need to develop GGR methodologies and standards, design new auctioning regimes, align with legislative timetables, implement necessary updates to the UK ETS registry and reporting platform, as well as ensure the UK ETS Authority is adequately resourced for this new functionality. The indicative timeline for integration broadly aligns with Climate Change Committee recommendations (to fully integrate GGR technologies only when those have matured and multiple facilities are operating) and the UK Net Zero Strategy[8].

Given uncertainties around GGR deployment rates and eligible projects during the initial integration period, the UK ETS Authority further proposes to set supply controls (through quantitative limits) on GGRs entering the UK ETS. These supply controls could facilitate phased GGR integration, and ensure market stability. One way that the UK ETS Authority could implement supply controls is by setting separate GGR caps, within overall UK ETS caps, which rise at predetermined amounts each year. Controls on the quality and robustness of eligible GGRs entering the market will also safeguard the integrity of the UK ETS. Aligned with this rationale, and to reduce administrative complexity, the UK ETS Authority proposes that only UK-based GGRs will be eligible for initial integration in the UK ETS.

7. Removals in the EU ETS

The EU Emissions Trading System (“EU ETS”) does not currently accept the use of GGRs for compliance purposes. However, the European Commission intends to report, by 31 July 2026, on how negative emissions technologies could be incentivised, and covered, by the EU ETS. As a precursor step, the EU is focusing on prescribing eligible permanent CO2 removal methods. For further information on this measure, please find our recent blog post on the EU Carbon Removals and Carbon Farming Certification (“CRCF”) Regulation here.

8. Through the Looking Glass

Ultimately, the Consultation (which closes on 15 August 2024) proposes a robust framework, and clear pathway, toward GGR integration in the UK ETS, albeit with many policy issues still to be resolved. The contours of these proposals remain subject to further clarification: while scaling up GGRs retains bipartisan support, the new Labour government’s evolving energy policies may bear upon the specificities of the UK ETS Authority’s proposed GGR integration measures. In particular, questions about how GGR integration will interact with complementary measures, such as the UK GGR Business Model and CCUS Cluster Sequencing Process, remain unresolved. Nonetheless, the Consultation proposes a compelling vision of how GGRs, as necessary components of any net zero calculus, might fit within a wider UK decarbonisation policy landscape.

[1] HM Government, Net Zero Strategy: Build Back Greener (October 2021), link here, p. 188.

[2] UK Climate Change Committee, Progress in reducing emissions: 2024 Report to Parliament (July 2024), link here, p. 81.

[3] Energy UK, UK Emissions Trading Scheme (28 June 2024), link here.

[4] HM Government, Guidance – Greenhouse gas removals (GGR): business model (20 December 2023), link here.

[5] UK Climate Change Committee, Sixth Carbon Budget: Greenhouse Gas Removals (December 2020), link here, p. 30.

[6] International Carbon Action Partnership, Emissions Trading Systems and Net Zero: Trading Removals (May 2021), link here.

[7] UK ETS Authority, Integrating Greenhouse Gas Removals in the UK Emissions Trading Scheme: A joint consultation of the UK Government, the Scottish Government, the Welsh Government and the Department of Agriculture, Environment and Rural Affairs for Northern Ireland (May 2024), link here, p. 16.

[8] UK Climate Change Committee, Letter: Development of the UK Emissions Trading Scheme (UK ETS) (11 October 2022), link here.

With thanks to Anders Pang and Leyla Manthorpe Rizatepe for their valuable contributions to this article.