New public offers and admissions to trading regime: FCA publishes further details - Highlights for Debt Capital Markets

The FCA has published further details of the public offers and admissions to trading regime that will come into force next year.

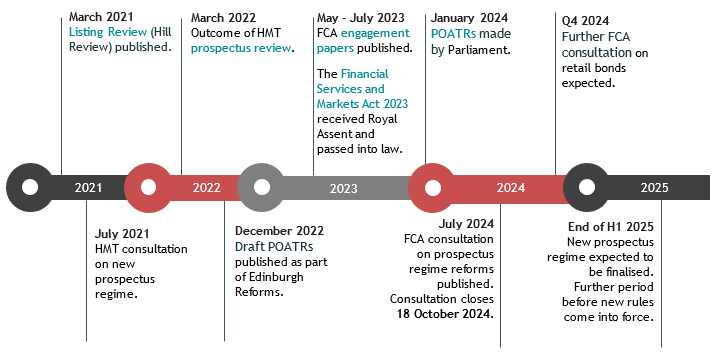

On 26 July 2024, the FCA published a consultation paper (CP24/12) relating to the exercise of its powers under the new public offers and admissions to trading regime. The consultation follows the Public Offers and Admissions to Trading Regulations (the “POATRS”) which were made by Parliament in January 2024 and provide a new framework to replace the UK Prospectus Regulation and give the FCA greater discretion to set new rules in this area (see our previous briefing on the POATRS).

In this briefing, we set out the key highlights for the debt capital markets. A separate briefing covers highlights for the equity capital markets.

BACKGROUND

The FCA’s proposals aim to reduce the costs of listing on UK markets, make capital raising easier on UK listed markets and remove barriers to retail participation. They dovetail with recent reforms to the Listing Regime (see our briefing on the listing reforms).

The FCA has previously sought feedback in this area through an engagement paper process in 2023 so many of the proposals set out in CP24/12 have been previously tested as part of that process (see our briefing on the engagement papers).

Alongside CP24/12, the FCA has also published a consultation on proposed rules for the new regulated activity of operating a public offer platform (CP24/13). Our ECM briefing covers this in further detail.

CONSULTATION PAPER (CP24/12): HIGHLIGHTS FOR DCM

The FCA intends to replace the current UK Prospectus Regulation Rules with a new Prospectus Rules: Admission to Trading on a Regulated Market sourcebook (PRM) which, together with the POATRS, form the basis of the new UK prospectus regime. Whilst this may look different to the current UK Prospectus Regulation and related rules, the intention is to retain a large degree of consistency in substance between the current and new UK prospectus regime. Overall, the proposed changes represent targeted improvements, rather than wholesale reform, for the debt capital markets, with some refinements aimed at reducing costs for issuers, improving market access or improving the quality of information for investors. Key highlights for DCM are as follows:

Sustainability Related Disclosures in Prospectuses

The FCA sets out specific proposals in relation to prospectuses relating to sustainability-labelled debt securities (both use of proceeds bonds and sustainability-linked bonds) in the form of additional disclosure rules which are aimed at corporate issuers only. The rules are framed as voluntary disclosures to ‘preserve some flexibility for issuers’ and are similar to ESMA’s expectations of sustainability disclosures in prospectuses under the EU prospectus regime.

These additional disclosures are broadly in line with best practice and include disclosures common to all types of sustainability-labelled debt securities (such as availability of frameworks, whether any standards or principles have been followed in developing the framework and details of any external reviews) as well as specific disclosures related to use of proceeds bonds and sustainability-linked bonds (which includes information that would typically be included in bond frameworks).

For use of proceeds bonds, requirements include detail on project selection and evaluation, external reviews, management of proceeds and post-issuance information. For sustainability-linked bonds, requirements include information on selection of key performance indicators, sustainability performance targets and the financial consequences of failure to meet those targets.

There are no proposals to apply sustainability-related disclosure requirements to issuer-level disclosure for debt. However, the FCA flags that information on climate change and other ESG-related matters may need to be provided in debt prospectuses where relevant to the issuer in line with the “necessary information” test (as set out in FCA’s Technical Note TN/801.2).

The FCA also highlights that it does not intend to create a bond standard for sustainability-labelled debt securities at present.

Future Incorporation by Reference

Similar to what is proposed under reforms to the EU prospectus regime under the upcoming EU Listing Act, the FCA proposes to allow future incorporation by reference of financial information in MTN base prospectuses, without the need to supplement, provided that such information is published through a regulatory information service. Issuers can continue to use supplements for this purpose if they wish to do so.

Supplements

The FCA proposes to allow more flexibility in what can be included in supplements for debt securities so that there are fewer cases where the prospectus has to be updated in its entirety or a drawdown prospectus has to be produced. For example, adding the ability to issue green bonds would be permitted via supplement, however, adding the ability to issue asset-backed securities or securities with a derivative element would require a full prospectus for comprehensibility.

Prospectus Content Requirements and Summaries

Save for the changes described above, the FCA proposes to broadly maintain the existing content requirements for prospectuses for admission to trading on a regulated market. Additional flexibility is proposed in relation to summary requirements for retail issuance, where the FCA proposes removing the requirements for detailed financial information in the summary and increasing the limit on summaries from 7 to 10 pages.

Protected Forward-Looking Statements

To encourage issuers to disclose more detailed forward-looking information in prospectuses, the POATRS establish a different liability threshold (based on fraud or recklessness) for certain categories of forward-looking statements (“Protected Forward-Looking Statements” or “PFLS”) in prospectuses or MTF admission prospectuses, with the FCA responsible for specifying what qualifies as PFLS and the labelling and other requirements that should apply to them. The FCA proposes to use a general definition that will apply to all PFLS disclosures together with category-specific criteria and specific exclusions. With regard to exclusions, the FCA proposes that mandatory prospectus annex disclosures should not be considered PFLS, however certain information such as profit forecasts can be considered provided they satisfy the relevant criteria. In particular, PFLS are expected to be clearly defined within a prospectus together with accompanying statements.

Whilst the concept of PFLS may be more relevant in an equity context, it may encourage issuers of debt securities to include forward-looking information, particularly in the context of sustainability disclosures.

Further Issuances

The FCA proposes not to include an option to use a simplified prospectus for further issuances of debt securities admitted to trading on the basis that the MTN programme architecture allows for issuers to issue further debt securities relatively easily. The FCA also proposes to increase the threshold for triggering a prospectus for further issuances from 20 per cent. (of existing fungible securities) to 75 per cent. across all asset classes.

The proposals contrast to the approach taken under reforms to the EU prospectus regime under the upcoming EU Listing Act where the existing fungible securities exemption threshold has been increased from 20 per cent. to 30 per cent. and a new fungible securities exemption is also proposed (see our briefing on the EU Listing Act reforms).

Retail Bonds

The FCA had previously outlined plans for incentivising issuance of retails bonds as part of its engagement paper process. The FCA plans to consult on this aspect in a separate consultation later this year.

Primary MTFs

The POATR give the FCA certain rule-making powers in relation to securities admitted to trading on a primary MTF. These powers will broadly allow the FCA to require an ‘MTF admission prospectus’ to be published where transferable securities are admitted to trading on a primary MTF that is open to retail investors. The POATRS also give the FCA rule-making powers in relation to prospectus responsibility, withdrawal rights and advertisements for admissions to trading on all Primary MTFs, including qualified investor only MTFs (“QI-only MTFs”). In particular, for withdrawal rights, the FCA proposes to apply such rights where a Primary MTF issuer publishes a supplement relating to a public offer (the applicability to QI-only MTFs will depend on the rules set by the market operator for when a supplement is required). For advertisements, the FCA proposes to extend the advertisements regime (currently applicable to regulated market admissions) to Primary MTF admissions.

TIMING AND NEXT STEPS

Comments on the consultation are requested by 18 October 2024. The FCA aims to finalise the rules for the new Public Offers and Admissions to Trading regime by the end of the first half of 2025. There is to be a further period prior to the new rules coming into force so we may not see the new UK prospectus regime in place until the second half of 2025.

Timeline for UK Prospectus Regime Reforms

For full details of the links in the timeline, please view the PDF.