23 min read

The new rules on Article 6 of the Paris Agreement, agreed at COP26, offer an international governance framework for deploying environmentally effective and transparent carbon markets. These carbon markets could help enable companies, and other private actors, to achieve their net zero targets at lower cost. Article 6 carbon market mechanisms can also generate additional revenues for emissions reduction projects, which might help enhance the commercial viability of those projects.

However, work remains for private actors, industry groups, governments, and regulators to refine, and ratchet up, the Article 6 rules. This work may help to progressively increase the environmental and social integrity, liquidity, and value of international carbon markets. Within this dynamic policy environment, we analyse some key features of the new rules on Article 6, and highlight several factors that companies might wish to consider if they decide to participate as investors, project operators, purchasers, or sellers in these markets.

Many companies and countries have now adopted ambitious decarbonisation plans. A strategy for achieving those targets at lower cost is through the use of environmentally effective carbon markets. Meanwhile, these instruments could help drive the financial flows necessary to ensure the world remains within a 1.5°C pathway (or as close as possible to it). For this reason, public and private actors have long sought clarification on Article 6 of the Paris Agreement, which addresses both “market” and “non-market” mechanisms for compliance purposes. After six years of negotiations, countries at the recent COP26 UN Climate Change Conference formally approved the rules required for Article 6 to operate.

This article seeks to demystify some of the complexities around the new Article 6 carbon market architecture. It also considers how the new mechanisms might be used to spur investment in clean energy and emissions reduction projects. Furthermore, this article highlights crucial factors that investors, project operators, purchasers, or sellers in these markets may wish to consider.

It is important to note, at the outset, that the new Article 6 rules relate specifically to compliance markets. These are mandatory regulatory regimes established by governments to reduce emissions across an economy or sector. Yet, they may also have indirect consequences for voluntary markets, in which private actors trade carbon credits—on a voluntary basis—to meet their climate targets. As such, the Article 6 rules summarised below will be relevant both for private actors subject to existing compliance schemes, as well as those seeking to voluntarily use carbon credits to meet their climate targets.

High-integrity carbon markets depend on governance

The prices of carbon credits traded in international carbon markets have now reached their highest-ever levels, driven in part by the COP26 outcome on Article 6. A series of complex rules underpin these markets, making the robustness of these rules a crucial factor in their investability. An important aspect of these rules, discussed below, is how public and private actors interact in the operation of carbon markets. Several features of the Glasgow Climate Pact, agreed at COP26, signal an exponential expansion in the implementation, and financial value, of carbon markets in the coming years:

- The Pact’s upgraded references to 1.5°C as a necessary, rather than aspirational, target implies a need for public and private actors to scale up their climate ambition, thereby tightening supply in carbon markets.

- Language specifying a target of reducing 2030 global emissions by 45%, relative to 2010 levels. This signals increasing regulatory measures to reduce emissions in the short term.

- Accelerating ambition towards the 1.5°C pathway, the Pact observes, requires governments to submit updated national climate targets at next year’s COP27. This measure effectively shortens the timescale for delivering updated targets by three years.

- During COP26’s controversial endgame, negotiators specifically endorsed accelerating the “phase-down” of coal power, and “phase-out” of inefficient fossil fuel subsidies. This foreshadows governments’ intention to enact progressively stronger emission reduction policies.

The road from Kyoto to Glasgow

All carbon market mechanisms share a common history. They first emerged from the Kyoto Protocol in 1997, which created a set of new legal instruments for emissions reductions and removals to be tracked and traded. These so-called “flexibility mechanisms”—international emissions trading (“IET”), joint implementation (“JI”), and the clean development mechanism (“CDM”)—generated significant flows of public-private finance for companies and countries, while reducing global emissions by up to 4.3 gigatonnes of carbon dioxide equivalent (“GtCO2e”). IET was a mechanism that allowed for the trading of emissions between developed countries. The CDM and JI, by contrast, were offsetting mechanisms. Generated from projects in developing countries, which did not have climate targets under the Kyoto Protocol, CDM-generated credits could be used to meet developed country climate targets. By contrast, JI operated between developed countries.

The flexibility mechanisms led to the emergence of domestic compliance schemes—including the European Union Emission Trading System (“ETS”), the UK ETS, and China ETS (which are policy instruments used to reduce emissions in those countries and regions)—as well as voluntary markets—such as the Carbon Offsetting and Reduction Scheme for International Aviation (“CORSIA”).

To their supporters, at a macro level, carbon markets offer the possibility of raising countries’ and companies’ climate ambitions, while lowering the costs of achieving those targets by up to US$250 billion per year by 2030. Such cost reductions can, in turn, unlock resources to increase the latitude of public and private actors to scale up global climate ambition. Reinvesting these avoided costs would, on some estimates, allow a doubling of pledged annual emission reductions. Aligned with this rationale, many global net zero targets depend on using carbon markets to promote higher mitigation ambitions, especially in hard-to-abate sectors. In relation to specific investment opportunities, revenues from the sale of carbon credits may also provide an additional revenue stream for eligible projects. With rapidly increasing carbon credit prices, carbon market instruments could go some way to making novel abatement technologies commercially viable.

To their critics, however, using carbon markets threatens ambitions to lower global emissions. Some argue that carbon markets offer regulatory loopholes that might facilitate greenwashing. Meanwhile, others argue that these market-based mechanisms create incentives for countries and companies to divert their attentions away from reducing their own emissions (rather than purchasing emissions reductions from elsewhere). Flaws in market design and implementation have led to occasionally-wild fluctuations in the price of carbon credits—each representing one tonne of CO2e—generated from market-based mechanisms. These debates demonstrate the complex moral values and technical rules underpinning international carbon markets.

The new Article 6 rulebook explained

Article 6 of the Paris Agreement epitomises these debates. It introduces three arrangements for countries to cooperate with each other, on a voluntary basis, to reduce emissions:

- Article 6.2: Internationally Transferred Mitigations Outcomes.

- Article 6.4: The sustainable development mechanism.

- Article 6.8: Non-market approaches.

Countries applying any of these “cooperative approaches” to achieve their climate targets (otherwise known as “Nationally Determined Contributions”, or simply “NDCs”) must abide by rules and guidance set out by the Conference of the Parties (“COP”). Importantly, these rules have the capacity to either significantly enhance, or undermine, the Paris Agreement’s overall ambition.

It is unsurprising, then, that just as Article 6 was the final treaty provision countries agreed before adopting the Paris Agreement in 2015, finalising rules to operationalise Article 6 eluded any negotiated outcome until COP26. Indeed, negotiators took three more years to finalise Article 6’s implementation rules than the rest of the “Paris Rulebook”. Over this period, governments debated a succession of texts of varying length, detail, and maturity. Countless policy options and extensive brackets in previous text iterations reveal the diversity of views across governments and stakeholder groups.

Article 6.2: Internationally Transferred Mitigations Outcomes

The first arrangement on voluntary cooperation, established through Article 6.2, allows a country that overachieves on its climate targets to transfer carbon credits—called “Internationally Transferred Mitigations Outcomes” (or “ITMOs”)—to another country for use in meeting that other country’s targets. Building on the Kyoto Protocol’s IET mechanism, the new rules clarify that countries can make their own bilateral and multilateral arrangements to trade carbon credits. However, the text also explains that countries transferring or trading ITMOs between one another must, in all such situations, apply what is known as “corresponding adjustments” to ensure each carbon credit counts only towards one country’s climate targets (refer to Figure 1).

Figure 1: Example of an ITMO transfer and corresponding adjustment

Source: Slaughter and May (2021)

Put alternatively, the new rules establish an accounting framework. This framework is designed to avoid counting emissions reductions toward multiple countries’ climate targets (so-called “double-counting”). It also obliges countries to denominate ITMOs in either CO2e, or another non-greenhouse gas metric (such as renewable energy targets). The metric used to transact ITMOs should be determined by—and consistent with—the participating countries’ climate targets. To achieve this, the participating countries might have to apply conversion factors in order to account for the transaction.

Whilst the rules afford some discretion, a country’s efforts to measure, report and verify (“MRV”) progress toward its targets must nevertheless follow international standards set out by the Intergovernmental Panel on Climate Change (“IPCC”) and United Nations Framework Convention on Climate Change (“UNFCCC”). Through this accounting framework, ITMOs might function akin to a “gold standard”. Carbon credits from different carbon markets could be fixed to a standard fungible carbon credit: an ITMO representing either one tonne of CO2e, or another appropriate metric.

The new rules “strongly encourage” countries trading ITMOs to “contribute resources” for vulnerable countries’ efforts to adapt to climate change. Yet, any such contributions—financial or otherwise—remain voluntary. Unlike the new Article 6.4 arrangements, discussed below, the Article 6.2 rules do not impose any mandatory levy or transaction tax (otherwise known as a “share of proceeds”) on ITMO transfers.

Article 6.2’s rulebook offers accounting guidance for governments deciding to authorise, and account for, credits generated from carbon markets for ITMO transactions. Notably, for private actors, we expect that domestic compliance market rules will be adjusted to accommodate Article 6.2 requirements. Under the existing international rules, however, Article 6 does not currently regulate voluntary carbon markets directly. It remains at the discretion of each voluntary market, participant, and government to determine whether, and the extent to which, they apply accounting adjustments for credits they generate, sell, or purchase in any given circumstance. Nonetheless, adjustments under the Article 6.2 mechanism for any credits transferred abroad for private use—in either voluntary or compliance markets—would ensure that those credits will only be used once: by the acquiring country, and not also by the originating country.

Practically, this means that voluntary market participants may regard an “adjusted credit”—that has been authorised, and subject to corresponding adjustments, by its originating country—to be of higher quality or environmental integrity than a “non-adjusted” carbon credit, which may be subject to less rigorous or transparent standards. Aligned with this, market participants might also perceive adjusted credits as more credible and robust, which may also help allay fears of greenwashing. This divergence could lead to bifurcated secondary markets, whereby credits subject to corresponding adjustments will command higher prices. Such a bifurcation could have large impacts on the demand of carbon credits sourced from various voluntary markets.

|

Example: Company A—which participates in the Swiss ETS—sells a carbon credit to Company B, which intends to use that credit to help meet its obligations under the EU ETS. The Swiss ETS is linked to the EU ETS, which enables participants in each scheme to use credits from the other for compliance purposes. The Swiss government would account for this transaction by transferring one ITMO to the EU through the international registry. |

Article 6.4: The sustainable development mechanism

The second cooperative arrangement, established under Article 6.4, is a new sustainable development mechanism (“SDM”). This SDM is a centralised mechanism, governed by the United Nations and overseen by a new Supervisory Body. An evolution of the CDM and JI offsetting mechanisms—under which new projects are no longer registrable—the SDM allows private companies or countries to trade emissions reductions. The mechanism can generate carbon credits from specific emissions “avoidance” or “removal” activities in the host country—such as building wind farms, installing low-carbon heating, or planting forests—to count toward another country’s climate targets.

Like the CDM and JI, private actors will have essential roles to play as project financiers, developers, and operators of SDM activities. By engaging in these activities, the SDM will facilitate private investment between participating public and private actors. Indeed, the sale of Article 6.4 emissions reductions (“A6.4ERs”) may constitute a potential new revenue stream for eligible projects, particularly if these are eventually accepted for use in compliance markets—such as the EU ETS or the UK ETS—or recognised by voluntary markets.

Allowing the use of A6.4ERs to meet domestic carbon price liabilities—like those incurred by firms covered under the EU ETS or UK ETS—could significantly increase demand for those carbon credits, thereby increasing their prices. However, opinion is split on the extent to which governments might implement such policies. It is perhaps useful to note that the EU ETS was previously linked to the CDM. This ended with the commencement of the EU ETS Phase 4 reforms, at the beginning of 2021, in a measure designed to reflect environmental integrity concerns, and raise the EU’s domestic climate ambitions. Nevertheless, with the inauguration of the SDM, governments and regulators are likely to closely examine the potential of A6.4ERs to reduce covered firms’ ETS compliance costs without affecting the integrity of either those domestic schemes, or national climate targets.

With many public and private actors intending to use offsetting to achieve their climate targets, at least in some capacity, the added clarity on Article 6.4 may represent a crucial step toward net zero. Although Article 6.4(V) provides some guidance as to eligible activities, many of the precise requirements and procedures for establishing SDM activities, including which activities are eligible for carbon credits, remain to be determined through the work of future COPs and the SDM Supervisory Body.

The new rules do clarify, however, that SDM activities can generate credits for “real, measurable and long-term” emissions reductions, as measured against a hypothetical “business as usual” baseline scenario. SDM activities must also minimise, and fully address, any risks of “reversals” or “non-permanence” from the activity. This includes rectifying any reversals. The Article 6.4 rules further indicate that SDM activities must avoid negative environmental and social impacts, as well as undergo local public consultation consistent with host country laws.

Demonstrating “additionality” is a fundamental element of any SDM activity. This involves proving that the activity could not have occurred without investment derived from the SDM. Such an assessment must account for existing and anticipated laws or policies applicable in the jurisdiction where the proposed SDM activity will occur. In measuring a baseline emissions trajectory, against which emissions reductions are to be measured, project operators (also called “activity participants”)—which are responsible for designing SDM projects and monitoring actual emissions from those projects—must apply at least one of the following methodologies:

- The best available technologies which are economically feasible and environmentally appropriate for each activity.

- The average emissions level of the best-performing comparable activities that provide similar outputs and services in equivalent social, economic, environmental, and technological circumstances.

- Actual or historical emissions, adjusted to align with the host country’s NDCs and low-emissions development strategies.

|

Example: A company could develop an offshore wind farm in a host country, displacing the need to build a coal-fired power plant. The project reduces emissions in the host country, which also benefits from the renewable energy generated. The company will receive A6.4ERs equivalent to the emissions reductions generated from the project. That company could then sell its A6.4ERs to other countries. Alternatively, it could sell to private actors seeking to meet their net zero targets or domestic carbon price liabilities (such as from the EU ETS or UK ETS, insofar as those schemes might eventually allow the use of A6.4ERs). Importantly, the A6.4ERs may only count towards a purchasing country’s climate targets if corresponding adjustments are made by the host country to avoid double counting. |

The new rules indicate that a SDM Supervisory Body, composed of member state representatives, must formally register any SDM activities. The Supervisory Body will register activities that are authorised and approved by host countries, validated by an independent, accredited auditor—known as a Designated Operational Entity (or “DOE”)—and that meet any other requirements set out by the Supervisory Body.

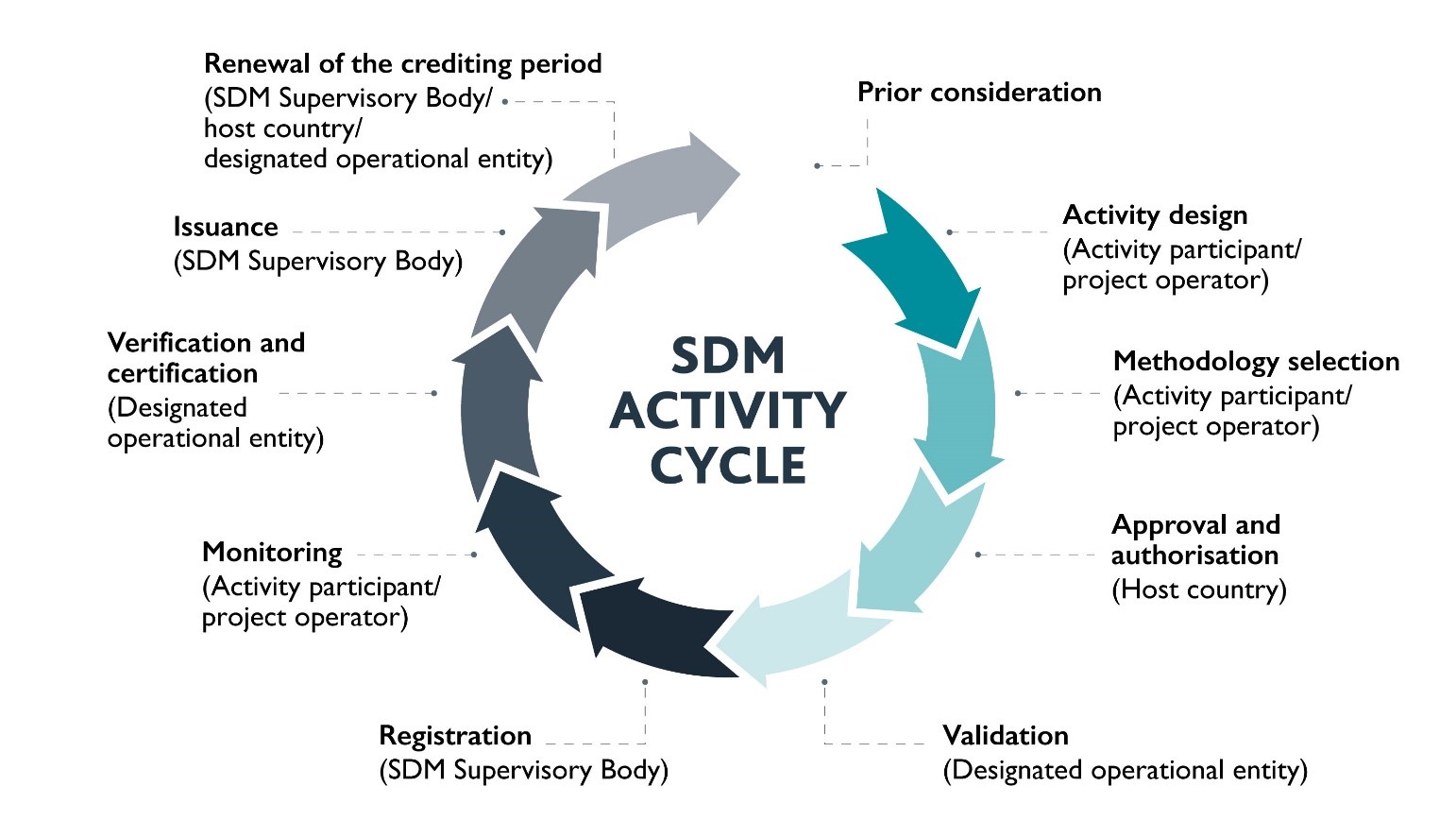

During the activity’s operational life, a DOE must also verify and certify emissions reductions reported by the activity participant, as a basis for the Supervisory Body issuing Article 6.4ER credits to the activity participants’ holding accounts located in the SDM registry. At their discretion, countries participating in the SDM may also authorise A6.4ERs generated from the SDM for use as ITMOs, in which case, those countries would need to apply corresponding adjustments to reflect such transactions. Figure 2 illustrates an anticipated SDM activity cycle.

Unlike the CDM, the SDM permits a host country to offer longer credit issuance periods for removals activities (such as carbon capture, use, and storage (“CCUS”) and direct air capture projects) than avoidance activities (such as installing a solar power facility instead of a coal-fired power plant). Approved SDM removals activities could generate credits for 15 years (with an option to renew that period twice).

Figure 2: Anticipated SDM Activity Cycle

Source: Slaughter and May (2021)

By comparison, avoidance activities could either receive credits for five years—with an option to renew twice—or for a single non-renewable period of 10 years. This difference reflects the higher investment risks, time periods, and necessary rates of return intrinsic to removal activities. These crediting periods reflect a maximum, with actual crediting periods varying according to the rules adopted by the relevant host country.

The Article 6.4 rules apply a share of proceeds levy to the SDM. That levy sets aside 5% of A6.4ERs—at the point of issuance of those credits—to pay into a United Nations Adaptation Fund for developing country climate adaptation. This levy could unlock billions of pounds in funding for protecting forests, building renewable energy infrastructure, hydrogen production plants, and battery storage facilities, as well as other projects to tackle climate change. The Supervisory Body also intends to charge an additional monetary levy—based on each project’s scale—to cover administrative expenses. The automatic cancellation of another 2% of credits generated from SDM activities is intended to ensure net increases in climate ambition. These cancelled credits will not be issued, making them ineligible for trading or counting toward any countries’ climate targets. While agreed at the request of small-island states, the measures will reduce projected revenue streams from SDM activities.

Finally, the rules carry over carbon credits from CDM projects registered since 2013. This makes available around 173 million extra carbon credits for countries to meet their first set of Paris Agreement climate targets (that is to say, for a duration of no more than five years). It is a compromise aimed at balancing concerns about flooding future markets and undermining the Paris Agreement’s ambition, with some countries’ economic interests and the interests of project developers holding large volumes of legacy carbon credits. It is, however, open for CDM projects to transfer into the SDM, provided a request is made by the project operator by 31 December 2023 and is approved by 31 December 2025.

Article 6.8: Non-market approaches

Article 6.8 of the Paris Agreement sets out a third type of voluntary cooperation. This provision aims to promote “non-market approaches” to reduce emissions. While the term is purposely left undefined, what seems clear is that these approaches do not involve any transfer, or trading, of emissions. In practice, the “non-market” label tends to capture such climate commitments, initiatives, pledge programmes, roadmaps, or statements made by multiple stakeholders.

The Glasgow Climate Pact sets up a work programme to report, share knowledge, and cooperate on these non-market approaches. Such approaches may indeed be as consequential, if not more so, than the outcomes of formal negotiations. Indeed, the COP Presidency, governments, companies, and other stakeholders used COP26 as a platform to announce many such non-market initiatives.

In a significant political move, for example, the world’s two largest emitters—China and the United States—announced that they would immediately resume close collaboration to hasten decarbonisation. In addition, the Glasgow Leaders’ Declaration on Forests and Land Use saw leaders—representing over 85% of the world’s forests—promise to cease, and reverse, deforestation by 2030. Another crucial initiative saw over 100 countries sign a Global Methane Pledge. This pledge collectively commits signatories to reduce methane emissions by at least 30%, relative to 2020 levels, by 2030. Leaders of more than 40 countries also endorsed a “Breakthrough Agenda”, committing to coordinate and accelerate deployment of clean technologies in the power, road transport, steel, and hydrogen sectors in affordable and accessible ways.

Private actors and sub-national governments also expanded commitments on non-market approaches during COP26. For instance, a group consisting of a 46-country coalition, five sub-national governments, and 26 private actors also committed to phasing out coal power and rapidly scaling-up clean power generation, while ensuring transitional support for workers and communities. A group of car manufacturers also announced a pledge, alongside 24 countries, to sell only zero-emissions vehicles from 2040.

However, perhaps the most striking of these announcements came from the Glasgow Financial Alliance for Net Zero (“GFANZ”)—a coalition of 450 asset owners, banks, and insurers holding around US$130 trillion in assets—pledging to cut emissions from their investing and lending activities to net zero by 2050.

Further clarity is needed on decisive issues

The new Article 6 rules offer some clarity and guidance on the three approaches to voluntary cooperation. Despite agreement in Glasgow, the effective operation of Article 6 will require further elaboration at future COP meetings. Further rules and guidance could help improve the transparency and stringency of Article 6 approaches. For example, more specific guidance from the COP and SDM Supervisory Body on how to measure an Article 6.4 activity’s “business as usual” baseline emissions trajectory would improve the consistency and environmental integrity of those activities. More clarification is also needed at the international level on how compliance and voluntary market accounting systems should interact, as well as the types of voluntary carbon credits that countries can authorise for use under Article 6.

Further guidance could also indicate how to address any social or economic impacts from carbon market mechanisms. Moreover, supplementary rules could determine preferable standards of MRV and compliance that countries and companies might use in implementing high-integrity carbon markets. We expect that further mandatory guidance—on electronic registry designs, registry infrastructure, as well as how to operate centralised accounting and reporting platforms—will also help develop and expand future Article 6 carbon markets.

In the interim, project developers, the financial sector, and civil society continue to build upon the Glasgow Climate Pact’s foundations. A number of initiatives are underway to ensure the robustness of the voluntary carbon markets. For instance, the Voluntary Carbon Markets Integrity Initiative (“VCMI”) is a global taskforce of private and public-sectors participants aiming to provide guidance and monitor the integrity of voluntary markets. It also plans to build countries’ capacity to access VCM financing opportunities.

Similarly, the Integrity Council for Voluntary Carbon Markets (“IC-VCM”) is a multi-stakeholder process aimed at supporting firms using carbon credits. It is devising “Core Carbon Principles”, setting criteria to identify and methodologies to assess high-integrity carbon credits. Through these activities, the IC-VCM intends to help foster robust, transparent, and liquid voluntary carbon markets. Notably, the IC-VCM proposes that use of carbon credits should be additive and complementary to, rather than a substitute for, own-firm and country-level emissions reductions. Slaughter and May is providing legal support for this important initiative.

Both the IC-VCM and VCMI may seek to build upon other initiatives, such as the San Jose Principles. These Principles—to which more than 32 countries, including the United Kingdom, are signatories—call on governments and corporate actors to implement the following measures:

- Apply corresponding adjustments for all transfers of offsets used for compliance purposes, as well as offsets used by corporate actors to meet voluntary climate goals through international voluntary carbon markets.

- Support transparent and credible corporate claims through national-level guidance.

- Consider possibilities to limit transacting pre-2020 carbon credits, including those from the CDM.

- Ensure that human rights, including those of indigenous peoples and other local communities, are protected when engaging in carbon markets.

Several prominent think tanks, industry groups, and civil society actors also outline the need for companies and countries to prioritise reducing their own emissions, rather than relying exclusively on purchased offsets to reach their climate targets. In other words, companies might experience reputational risks if their external emissions reductions are not supplementary to internal efforts to reduce emissions. Such efforts could also minimise the need to use offsets in the first place.

According to Oxford Net Zero, the amount of a company or country’s residual emissions, and appropriate use of offsets, is often sector specific. The proper level of offset use also depends on organisations’ available technologies, strategic goals, and financial strength. More concretely, the Science-Based Targets Initiative’s Net-Zero Standard suggests that, for most companies with net zero targets, offsets should be used to achieve no more than 10% of those companies’ total emissions.

Next steps

The Glasgow Climate Pact confirms that, as a climate mitigation and investment strategy, scaling carbon markets is now a primary objective of the world’s governments. The new Article 6 rules encode a new flexible pathway for private and public actors to cooperate to achieve net zero ambitions. They establish a basis for how private, public, and international actors may interact to deploy these mechanisms.

Project developers, financiers, operators, and prospective purchasers of emissions reductions may wish to position themselves within this dynamic policy environment. Possible steps include considering the extent to which engaging in carbon trading, market development, and implementation might align with an organisation’s purpose, objectives, and decarbonisation plans. Slaughter and May is increasingly assisting clients in this area.

Ultimately, work remains for private actors, industry groups, and public bodies to refine, and ratchet up, the Article 6 rules. One way to achieve this is by cultivating customs and conventions to guide the behaviour of carbon market participants. These can provide guidance on nascent or absent formal rules to help, for example, bridge existing gaps between compliance and voluntary carbon markets. The Article 6 rules signal the beginning of that task.